- Personal budget programs for free#

- Personal budget programs how to#

- Personal budget programs software#

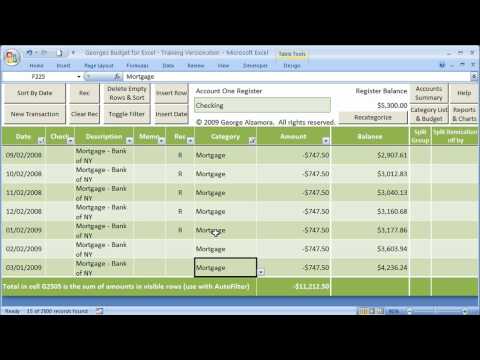

An easy to use personal finance software featuring budgeting, import transaction from your bank (MS Money, Quicken format) and much more.

Personal budget programs how to#

Learn how to budget and create a spending plan. Money Manager Ex is one of the best full-featured budget program that enables users to create multiple accounts, transactions, categories and reports. You can then make realistic assumptions about your annual income and expense and plan for long term financial goals like starting your own business, buying an investment or recreation property or retiring. Using a realistic budget to forecast your spending for the year can really help you with your long term financial planning. You can then look for ways to even out the highs and lows in your finances so that things can be more manageable and pleasant.Įxtending your budget out into the future also allows you to forecast how much money you will be able to save for important things like your vacation, a new vehicle, your first home or home renovations, an emergency savings account or your retirement. Best free budgeting apps: Mint, KOHO, and Wally. Here’s a quick summary of some of the best money apps you should consider today. By doing this you can easily forecast which months your finances may be tight and which ones you'll have extra money. Best Budgeting Apps and Personal Finance Apps. mybudgetpal for Budgeting, Tracking and Saving Money Lover for Budgeting Simplicity PocketSmith for Anyone with Multiple Income Streams Splitwise for. With a paid plan, you can predict your financial health for up to 30 years.

Plus, you can track your net worth like you can in Personal Capital. Once you create your first budget, begin to use it and get a good feel for how it can keep your finances on track, you may want to map out your spending plan or budget for 6 months to a year down the road. Best for: budget planning and what-if planning Cost: free, 9.95 or 19.95 per month PocketSmith tracks your spending, builds a budget and shows your upcoming bills in a calendar view.

Write down the amount that goes out each month on a regular.

Personal budget programs for free#

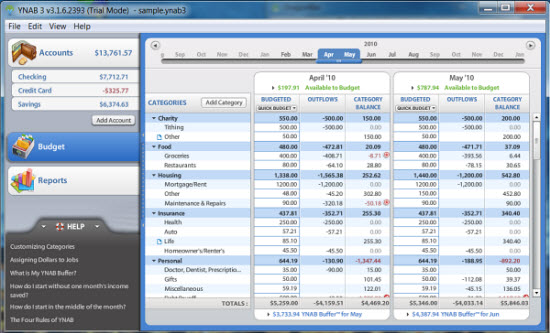

Take the Pain Out of Budgeting with an Interactive Budget Calculator That Guides You YNAB (You Need A Budget) 4.2 Learn More Read Our Full Review Cost After free trial, 14.99/month or 98.99/year Time Period for Free Version 34 days Number of Ratings 49,400+ Why We Picked It Pros. The illustration below shows the expected income and expenditure for a Junior Football Program for age groups 11 -16 years. Setting Up Your Budget Identify your monthly income or take-home pay from your regular paycheck. What about Budget Forecasting and Planning? Following a budget or spending plan will also keep you out of debt or help you work your way out of debt if you are currently in debt. Since budgeting allows you to create a spending plan for your money, it ensures that you will always have enough money for the things you need and the things that are important to you.

0 kommentar(er)

0 kommentar(er)